HMO is the acronym for health maintenance organizations. PPO is the acronym for preferred provider organizations. Both the terms refer to the healthcare industry. HMO and PPO are two types of health plan networks. There are many similarities between HMO and PPO but there are a few differences as well. Both these types of network are used by companies offering health insurance to their employees and people can voluntarily choose such healthcare plans as well.

Core Differences

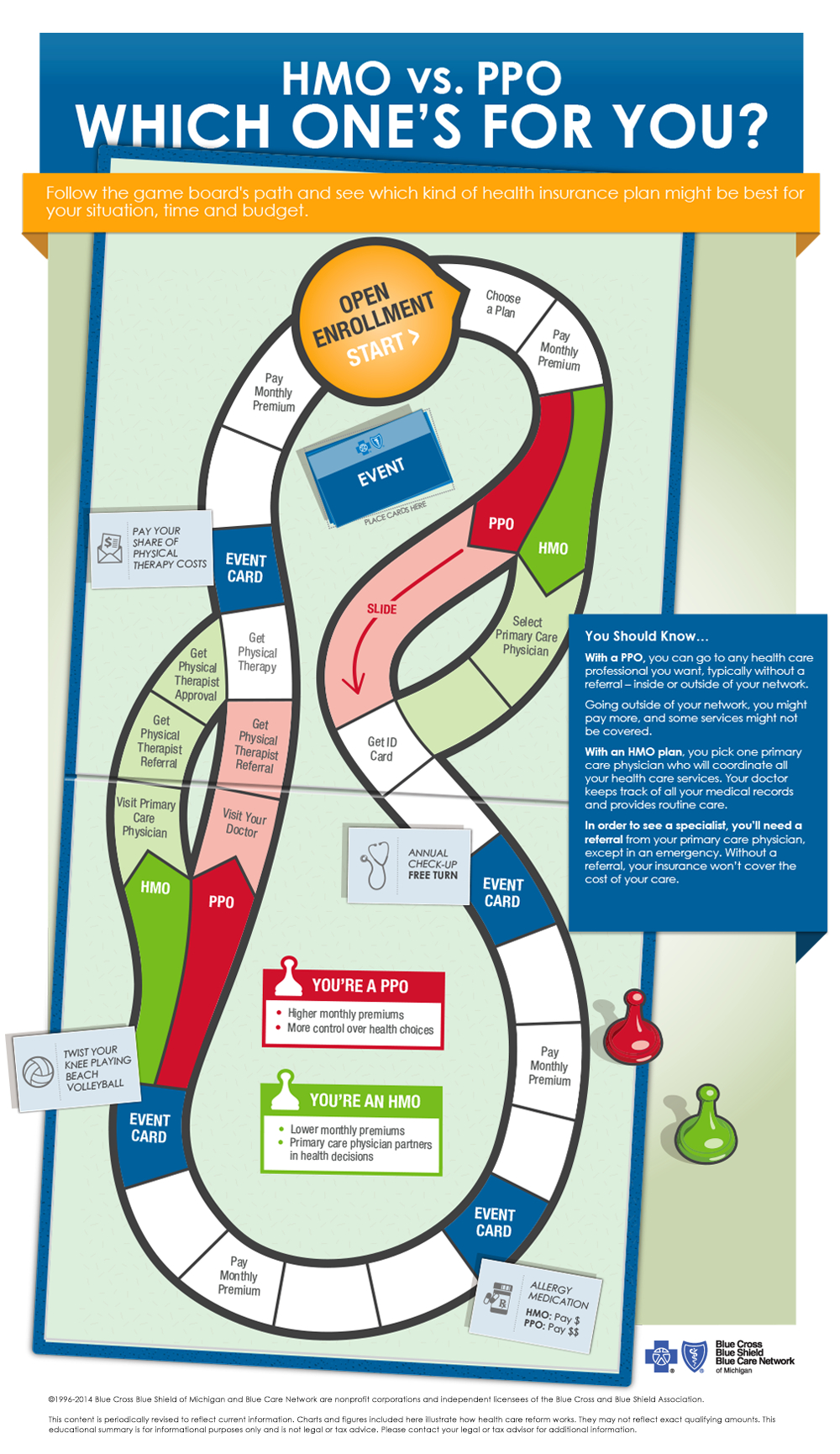

The primary difference between HMO and PPO is that the former requires a primary care physician while the latter doesn’t have any such requirement. A primary care physician, often known as a PCP, is a doctor who would be the first point of contact and often the only medical professional that the insured individual would be able to consult. A PCP can be a general physician, a gynecologist, a pediatrician or a doctor having multiple specializations.

Whenever a person is sick or ailing and requires any kind of medical intervention, he or she would have to consult the PCP. It is only after this consultation that he or she can get further treatments or medical recourse. The PCP would refer the insured to other doctors and only then would such follow up medical costs be covered by the health plan. The PCP would make references to doctors and labs that are in the network of the HMO plan.

PPO Coverage

With PPO, there is no such confinement or obligation to have a PCP. There is a network of preferred providers and doctors including all kinds of medical professionals, hospitals and labs. As long as the insured chooses any professional or medical center that is on the list of the preferred providers, the medical expenses are covered. Albeit, the coverage amount would come into play here!

HMO Coverage

With HMO, you cannot see a doctor or go to a hospital that is not included in the HMO network. If you do so, then none of the expenses would be covered. With PPO, you can visit hospitals, labs or see doctors who are out of the network of the PPO plan and you would still get coverage. However, the coverage wouldn’t be full. You may not get any coverage at all depending on the clauses of the PPO plan or you may get up to 60% or at times more with the PPO plan, as the terms would dictate.

HMO needs you to make co-payments and on spot payments on several occasions but PPO mostly doesn’t need you to pay any cash or in check at the time of getting treated. The doctors, labs or hospitals in the PPO network would make their claims and get directly reimbursed.